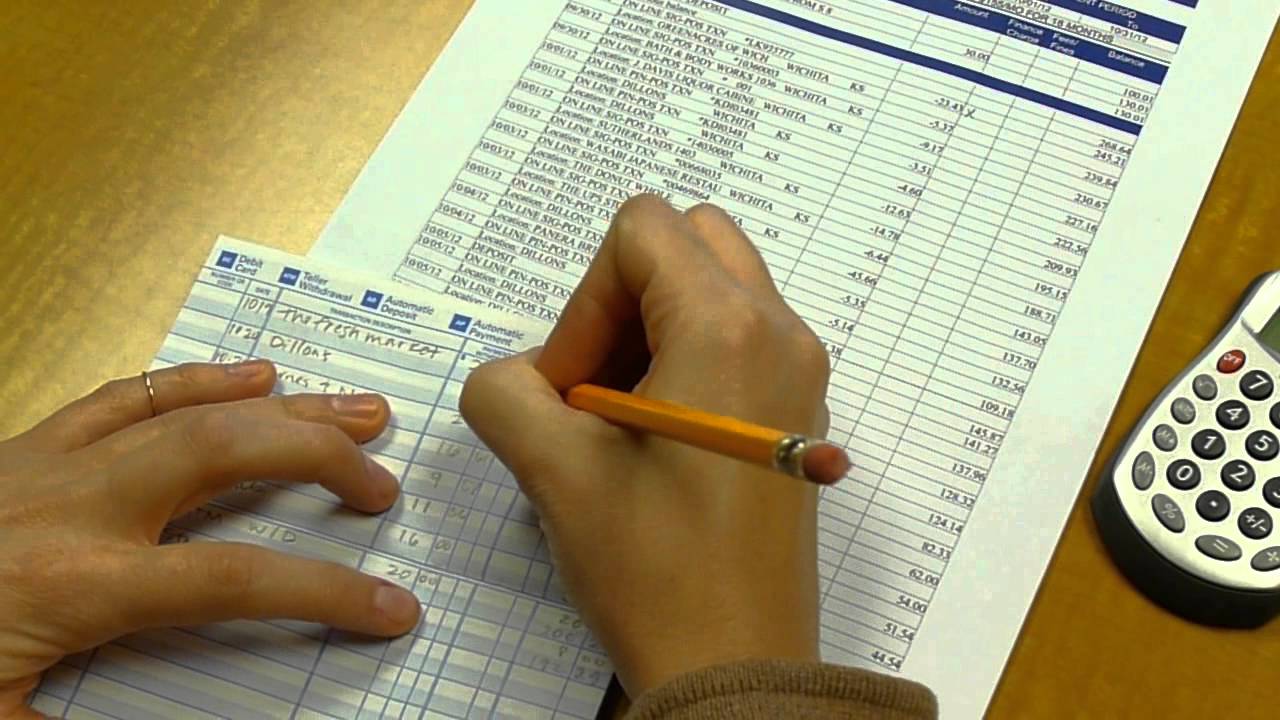

“I have not balanced my checkbook in years due to only writing around one to two checks per month. “I use a checkbook app to keep track of all my purchases.” – Jessica C. I rarely write checks anymore, so when I do it’s easy to just quickly check that the amounts look correct since there are only 3 or 4 checks coming through each month.” – Michelle To be honest, we could be a bit more diligent, but what we do works for us. We don’t compare receipts to posted amounts, but just make sure everything looks inline with what we know we’ve charged. My husband and I each look over our online transactions at least twice a week to make sure that the amounts and charges look accurate. “I don’t balance my checkbook the old fashioned way, but I do check my account pretty regularly. But for the most part, it works for me!” – Bryn This is definitely not a great habit as it can lead to overdraws and penalties if one is not careful or if you forget about a check that was written. I also try to use my bank’s online bill pay option whenever possible! Since I do not balance my checkbook, I just try to ensure my checking account always has enough “cushion” to cover the checks that I have written recently. The only time I ever find myself writing checks are to my kiddos’ schools (for field trips, party expenses, etc.), when I am making a big purchase that I want a record of (like buying a car or an item off of Craigslist) and sometimes to reimburse a friend/family member for something (but 99% of the time, I would prefer to give cash or use PayPal). “I have not balanced my checkbook in at least 3 years. Then I’ll wait until the check clears and will put a line through the item on the check pad.” – Irene I’ll write the # of the check, what it’s for, and the amount/date on the back part of the check pad. It’s not the perfect system, but it works for now.” – Jessica We have all of our monthly bills set up for auto-pay, but I do check my balance/bank account every day with their app just to make sure nothing is getting taken out that shouldn’t be. We only use checks in very rare circumstances which may just be the water bill. “What does balancing a checkbook even mean? (insert sarcasm) I have an app for that!” – Tiffany Even though we don’t write it down, we still keep track!” – Sara This helps us stay on track with the budget we set and what we save each pay period. “I don’t balance my checkbook, however, my husband keeps track on an app on his phone daily, and we are always in communication what all balances are at for our checking and savings accounts. I pay all of my bills at one time, and everything is charged to a credit card, so most everything is done online.” – Chelsey “I don’t – our water bill is the only thing that requires an actual check and it’s paid 4 times a year. However, I do monitor all my transactions online since so much of my spending is on my rewards credit card – just so I can catch something if a payment or account balance looks off.” – Emily “I write one check a month for rent, and all other bills are handled online, so I don’t bother balancing a checkbook. If we do write a check, it’s easy to see if it clears online.” – Lina “We write maybe one paper check a month, so no. I do keep a small list of the checks I write (and their numbers when I do have to write a check), so I know what to keep a lookout for when it clears online.” – Amber S.

I always stuck to my Dad’s mantra – and while it won’t work for everyone, it has for me: Never spend more money than you have.” – Jamie Here’s why team members DON’T physically balance their checkbook:

0 kommentar(er)

0 kommentar(er)